CAR ON INSTALLMENT

We provide solutions & services to get cars on installments all over Pakistan through Islamic Banks. We finance New and used cars on installment. We finance up to 9-year-old cars. We offer the lowest profit & takaful rates with the lowest down payment. We require easy documentation. You can learn about your eligibility, documentation, and products through this website. You can get the plan you require through WhatsApp. You can apply for a car finance facility from any city where our branch exists. You have to download the application form, sign it, and send us bank statements and a bank account maintenance letter.

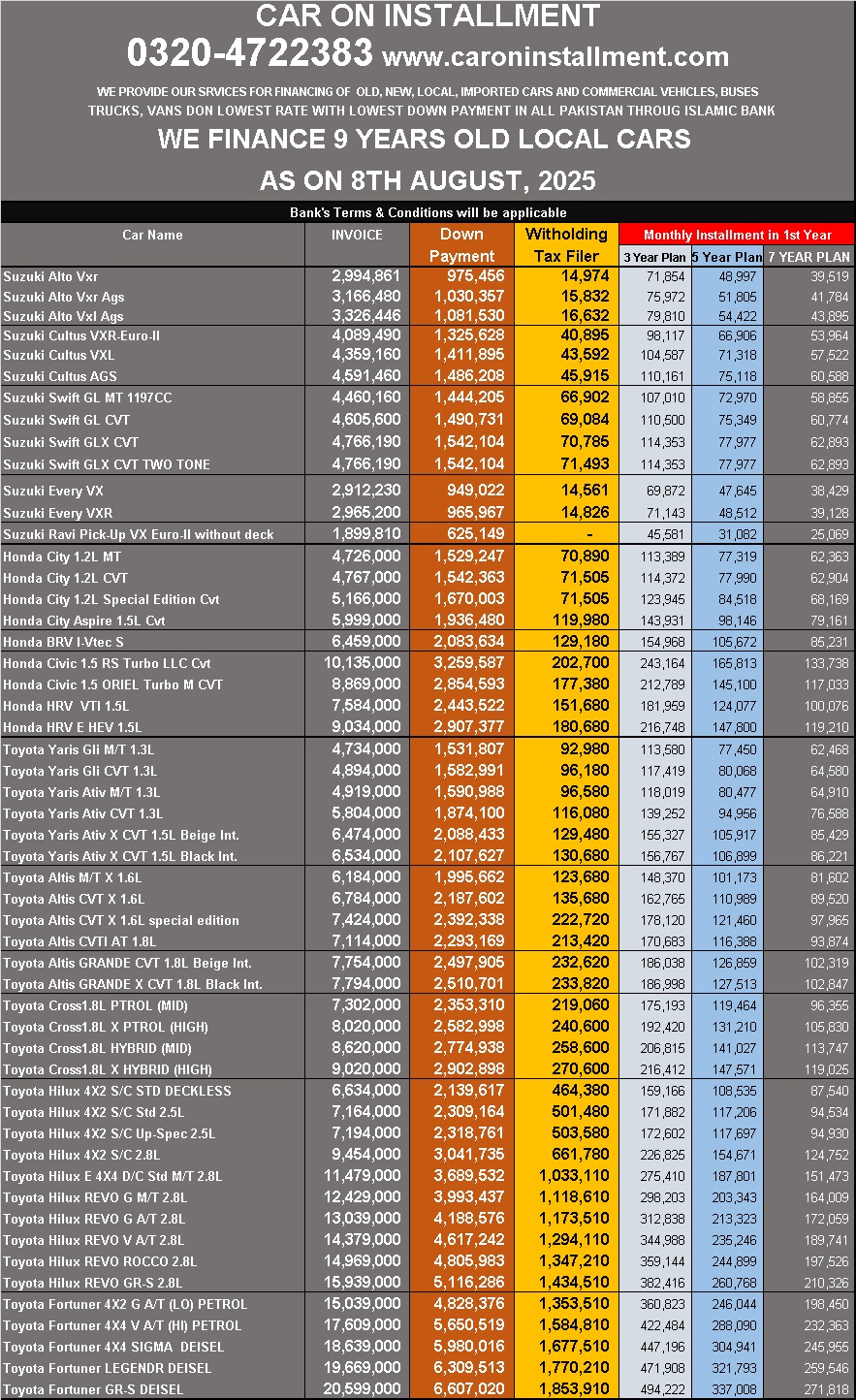

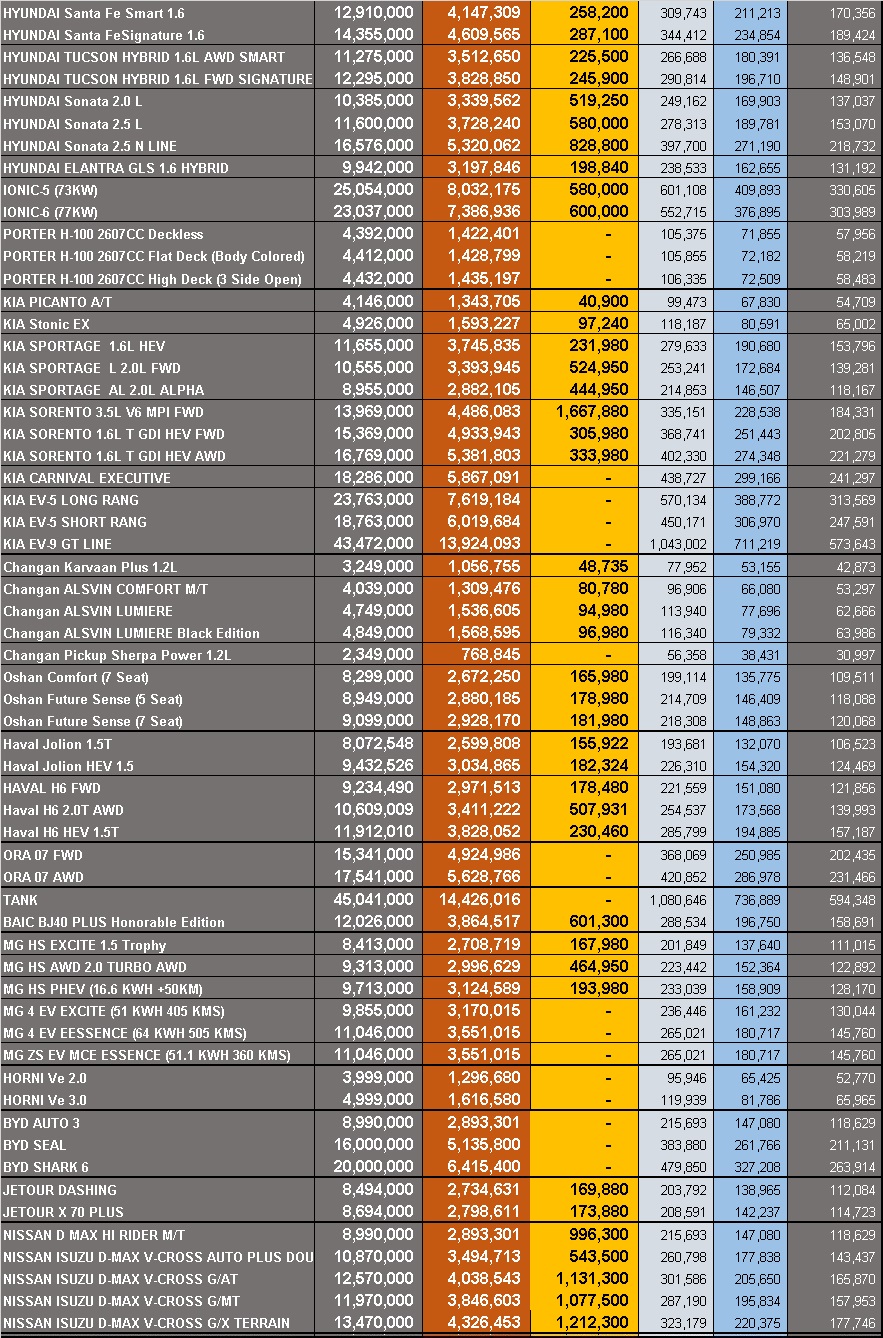

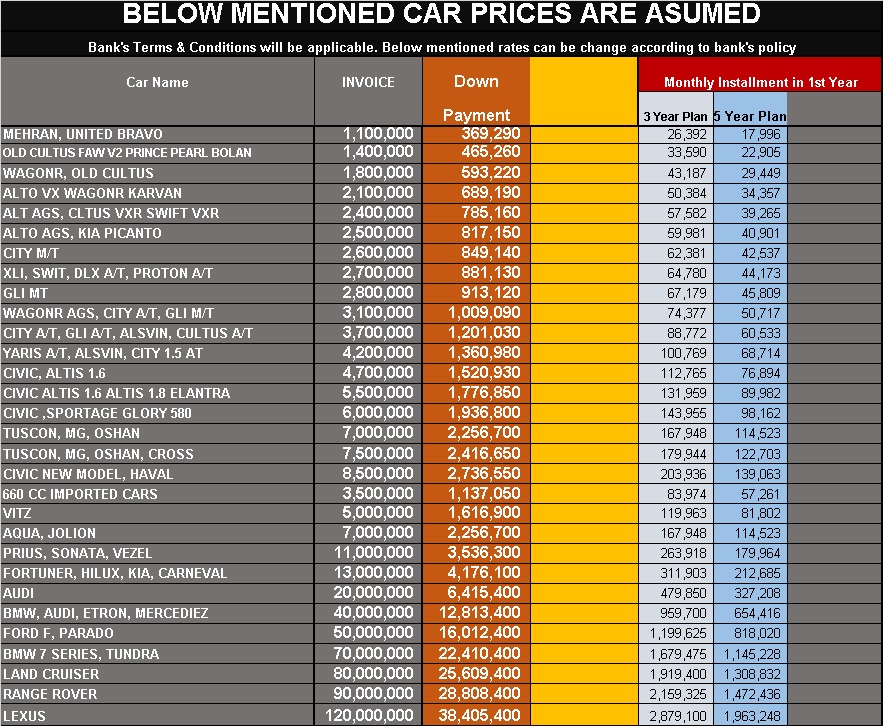

Car Financing Plan

These are some car financing plans that are available for you. Please go through them once to check if they are helpful to you. If not, then you can also request a custom car financing plan from us.

CUMMERCIAL VEHICLES

ALL TYPE OF COMMERCIAL VEHICLES CAN BE FINANCED

Custom Car Finance Plans

Car plan can be requested from 9 AM to 9 PM through Call, Sms, or WhatsApp at 0320-4722383. After providing the car name, down payment, and Tenure of your required car. You will get your required car financing plan within 24 hours.

Services

WE PROVIDE THE FOLLOWING SERVICES:

- Local, Imported New/Used Cars on Installment

- Luxury Cars on Installment, i.e., Land Cruiser, Audi, BMW, Lexus, Bentley, Range Rover, Rolls-Royce, Porsche, Ferrari, Mercedes

- Commercial Vehicles On Installment, i.e., Bus, Truck, Trailer Truck, Tractor, Van,

- Home Loan

- Business Loan / Personal Loan

- Loan on Existing Owned Car / Gold

- Car Sale, Purchase, or Replace

We provide loan financing through an Islamic bank. Services are provided in Pakistan where our branches are available.

Categories

We finance:

- All types of New Commercial Vehicles.

- New and up to 9-year-old Local Cars.

- New and up to 5-year-old Imported Cars.

- New and up to 5-year-old Luxury Cars.

LOAN ON EXISTING Cars

Self-Car Refinance: A Loan can be obtained on the already-owned car.

Down Payment: Minimum of TO 30%

Maximum Loan: unlimited

Tenure: 1 year to 5 years

WHO CAN APPLY

- Business Man

- Salaried Persons

- Pension Holders

- Overseas Persons

- Rental Income Holders

- Agriculture Land Owners

ELIGIBILITY CRITERIA

To know about your eligibility for car loan please study “Car Loan Info” page

Required Documents

To know about required documents for car loan please study “Car Loan Info” page

How to Apply

You can apply in any one of the following ways:

- If you are applying from Lahore Then Download the following forms, sign them and call us at 03204722383. We shall arrange to pick documents from your office

- If you are applying from any other city than send following signed documents, last 1 year bank statement & bank account maintenance latter and call us at 03204722383

HOME LOAN

- Loan for Purchase/ Construction or Renovation of Home

- Loan Amount: up to Rs. 800,000,000

- Minimum Down Payment: 40%

- Tenure: 1 to 20 Years

BUSINESS LOAN

Get a loan to increase your business

If you are doing any business then you can get 1 lac to 5 lac loan without any bank statement or any other document.

If you are doing any job with bank transferred salary or doing any business with good bank statement then you can apply for loan.